The U.S. Food and Drug Administration (FDA) didn’t just tweak its generic drug approval process between 2023 and 2025 - it rewrote the rules. If you’re a manufacturer, pharmacist, or patient relying on affordable medications, these changes directly impact you. The FDA generic approval system is now faster for some, harder for others, and more tied to where drugs are made than ever before.

Why the FDA Changed the Rules

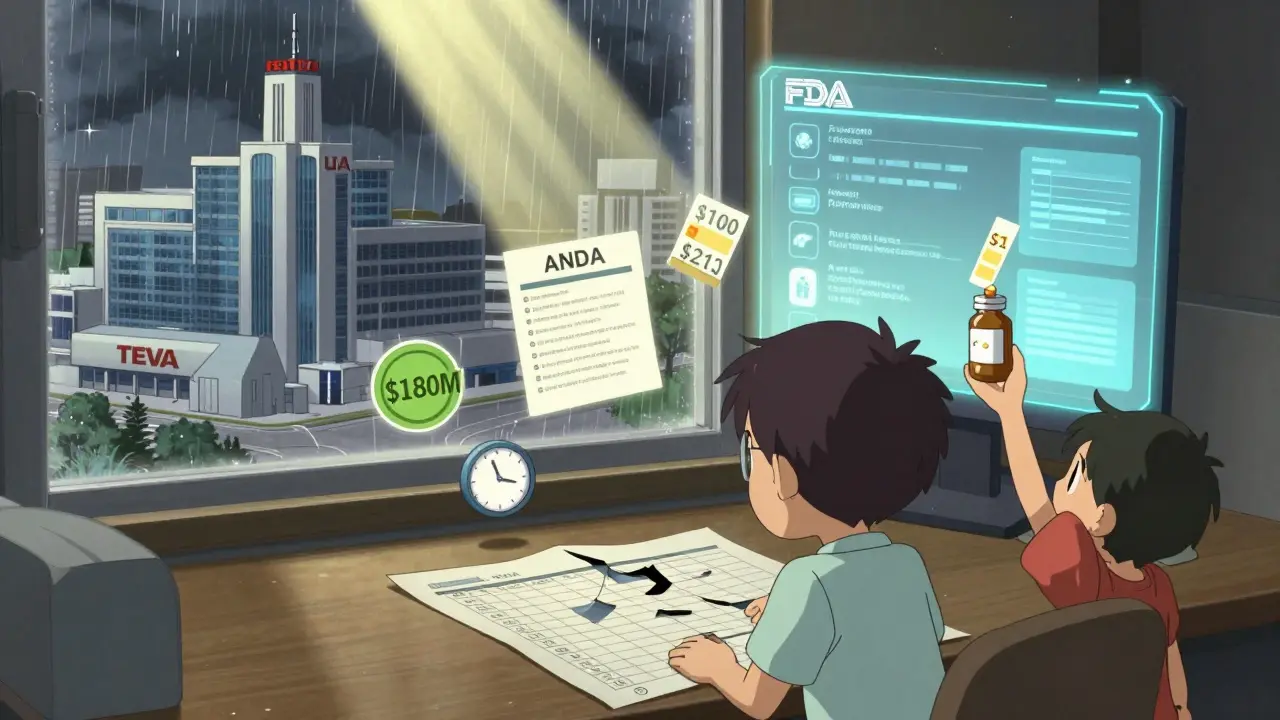

Back in 2020, the pandemic exposed a dangerous truth: the U.S. depends too much on foreign countries for life-saving generic drugs. More than half of all pharmaceuticals sold in America are made overseas. China and India together control over 66% of active pharmaceutical ingredient (API) production. When supply chains broke down, hospitals ran out of antibiotics, heart medications, and even basic painkillers. In response, the Biden administration pushed the FDA to act. The result? The ANDA Prioritization Pilot Program, launched in October 2025. This isn’t a minor update - it’s the biggest shift in generic drug review since 2012. The goal? Reduce shortages by making it easier and faster for companies to make generic drugs in the U.S.How the ANDA Prioritization Pilot Works

The pilot program gives a speed boost to generic drug applications that meet strict domestic manufacturing criteria. It’s not automatic. Manufacturers must prove every step - from making the active ingredient to testing bioequivalence - happens inside the U.S. There are four tiers of priority:- Tier 1: 100% U.S. manufacturing and testing. Fastest review - target of 8 months.

- Tier 2: 75-99% U.S. components. Review in 9-10 months.

- Tier 3: 50-74% U.S. components. Review in 10-12 months.

- Tier 4: Less than 50% U.S. components. Standard 12-15 month timeline.

Which Drugs Benefit the Most?

The FDA isn’t giving priority to every generic. The program focuses on drugs already on the Drug Shortage List - 147 medications as of September 2025. These include antibiotics like cefazolin, heart drugs like digoxin, and diabetes medications like metformin. First generic approvals are also surging. From January to mid-2025, the FDA approved 9 new first generics, including:- Ivermectin Tablet (for parasitic infections)

- Nimodipine Solution (for stroke recovery)

- Azilsartan Medoxomil and Chlorthalidone Tablet (for high blood pressure)

Who’s Winning - and Who’s Struggling?

Large manufacturers like Teva and Sandoz have the resources to shift production. Teva reported bringing nimodipine solution to market 8 months faster than planned. Mid-sized companies (50-500 employees) are the most active in the pilot, with 63% applying. But smaller firms are getting left behind. Setting up a U.S. manufacturing facility costs $120-180 million. Validating API suppliers adds $1.2-1.8 million per application. Many can’t afford it. A survey of 127 generic manufacturers found:- 54% are expanding U.S. facilities

- 31% have delayed product launches

- 79% say cost pressures are immediate and serious

What’s Still Excluded

Not all generics are eligible yet. Complex drugs like transdermal patches, nasal sprays, and ophthalmic suspensions were left out of the initial pilot. Why? They’re harder to replicate. Their bioequivalence testing is more complex, and manufacturing them domestically requires specialized equipment. But that’s changing. Starting January 2026, the FDA will expand the pilot to include these complex generics. New guidance is expected in late 2025.The Cost to Consumers

Here’s the big question: will this make drugs more expensive? MedPAC, the Medicare payment advisory group, estimates domestic production could raise generic drug prices by 12-18% in the short term. That’s because U.S. labor, regulatory compliance, and facility costs are higher than in India or China. But here’s the counterpoint: drug shortages cost the U.S. healthcare system over $20 billion annually. Emergency imports, last-minute replacements, and hospital stockpiling are far more expensive than building domestic capacity. The Congressional Budget Office predicts the program will become cost-neutral by 2027 and save $4.2 billion per year by 2030 - not because drugs get cheaper, but because we stop paying for crises.Expert Opinions: Is This a Good Move?

Dr. Rachel Sherman, former FDA deputy commissioner, warns the program could fragment the global supply chain that’s kept drug prices low for decades. The European Generic Medicines Association even filed a formal WTO inquiry in July 2025, arguing the program favors U.S. companies unfairly. But Dr. Aaron Kesselheim from Harvard found no drop in drug quality. His March 2025 study in JAMA Internal Medicine showed pilot-approved generics performed just as well as traditionally approved ones - within 95% confidence intervals for effectiveness. The FDA’s own data shows 94.7% of pilot applicants are satisfied with the faster reviews. Still, 63% complain about finding reliable U.S. sources for complex APIs.

What Manufacturers Must Do Now

If you’re a generic drug maker, here’s what you need to do:- Verify your API supplier is in the U.S. or meets FDA equivalence standards.

- Use only FDA-registered U.S. labs for bioequivalence testing.

- Ensure your manufacturing site passes CGMP inspections without delays.

- Update your ANDA to include full domestic verification documentation.

- Expect to spend 217+ hours on paperwork per application.

What’s Next?

The FDA is rolling out AI-assisted review tools to cut review times another 25% for pilot applicants. By 2028, domestic API manufacturing is projected to rise from 9% to 23%. The Pharmaceutical Supply Chain Resilience Act of 2025 is now in the Senate. If passed, it will lock in funding and support for domestic production - making these changes permanent. For patients, the future looks like this: fewer shortages, slightly higher prices for some generics, but more reliable access to the drugs you need.Frequently Asked Questions

What is the ANDA Prioritization Pilot Program?

The ANDA Prioritization Pilot Program is an FDA initiative launched in October 2025 that gives faster review timelines to generic drug applications that manufacture and test their products in the United States. It’s designed to reduce reliance on foreign supply chains and prevent drug shortages. Applications with 100% U.S. components can be approved in as little as 8 months, compared to the standard 12-15 months.

Do all generic drugs qualify for faster approval?

No. Only generics that meet specific domestic manufacturing criteria qualify. The program prioritizes drugs on the FDA’s Drug Shortage List and essential medicines. Complex generics like patches, nasal sprays, and eye drops were excluded at first but will be included starting January 2026.

Will generic drugs become more expensive because of this?

Short-term price increases of 12-18% are possible due to higher U.S. production costs. But long-term, the program aims to reduce the $20 billion annual cost of drug shortages. The Congressional Budget Office estimates net savings of $4.2 billion per year by 2030. Prices may stabilize after domestic capacity scales up.

How does this affect first generic drugs?

First generic approvals are accelerating. Through mid-2025, the FDA approved 9 first generics - up 18.7% from 2024. These drugs typically see price drops of 78.3% within six months of launch, making them more accessible. The pilot program gives manufacturers who produce these drugs in the U.S. a faster path to market.

Are U.S.-made generics safer or more effective?

Yes, in terms of reliability - not necessarily safety or effectiveness. FDA studies show U.S.-made generics under the pilot program perform just as well as those made overseas. The key difference is supply chain stability. You’re less likely to run out of your medication if it’s made domestically.

John O'Brien

January 26, 2026 AT 15:06This is straight-up corporate welfare disguised as national security. They’re giving tax breaks and fast tracks to Big Pharma while small labs go bankrupt. I’ve seen my insulin price jump 30% since this pilot started. You call that ‘reliability’? I call it extortion.

Paul Taylor

January 26, 2026 AT 22:05Look I get the fear of foreign supply chains but we’ve been trading pharma with India and China for decades because it works and it’s cheap and now we’re paying for the luxury of American labor and regulatory overhead and honestly if you think this is going to fix shortages you’re deluding yourself because the real bottleneck isn’t where the pill is made it’s where the active ingredient is sourced and if you think US labs can scale up API production overnight you’re living in a fantasy world

Desaundrea Morton-Pusey

January 27, 2026 AT 00:08AMERICA FIRST! If you can’t make it here you don’t deserve to be sold here. These foreign companies have been ripping us off for years. Let them sweat it out in Bangalore while we rebuild our pharmaceutical sovereignty. No more free rides. This is what patriotism looks like.

Murphy Game

January 28, 2026 AT 19:56They’re using ‘drug shortages’ as an excuse to shut out global competition. Did you know the FDA’s own database shows 80% of the flagged shortages were caused by price gouging and hoarding, not lack of supply? This isn’t about safety. It’s about creating a monopoly for the big players who own Congress. The AI review tools? Just a distraction. They’re automating the bias.

Kegan Powell

January 29, 2026 AT 07:02Bro this is actually kind of beautiful if you think about it 🤔 We’ve spent 30 years outsourcing everything and now we’re waking up to the fact that medicine isn’t just a product it’s a lifeline and if your life depends on it you want it made where you can hold the factory accountable. Yeah it’s gonna cost more at first but think about the ER visits we’ll avoid when people aren’t scrambling for metformin because their last bottle vanished. This isn’t protectionism it’s responsibility 💪

April Williams

January 30, 2026 AT 20:51Oh so now we’re supposed to trust American manufacturers? After all the opioid scandals and the contaminated heparin and the fake testing labs? You think this is a fix? It’s a cover-up. The FDA is just giving more power to the same corrupt players who let us down before. I’ve seen the inspection reports. They’re a joke. This isn’t safety. It’s propaganda.

Harry Henderson

February 1, 2026 AT 10:58Enough with the excuses. If you’re a manufacturer and you can’t afford to make it here then you’re not fit to be in this industry. We’ve got the brains. We’ve got the talent. We’ve got the infrastructure. Stop crying about $120 million and start building. America doesn’t need handouts. It needs grit. Get off your ass and make the pills.

suhail ahmed

February 2, 2026 AT 21:29India made the world’s vaccines during the pandemic and now we’re being painted as villains? The truth is we’ve been the backbone of global generics for decades - affordable, reliable, scalable. You want domestic production? Fine. But don’t erase the contributions of thousands of Indian scientists and workers who kept your grandparents alive. This isn’t nationalism - it’s amnesia.

Candice Hartley

February 4, 2026 AT 01:33My dad’s on digoxin. He’s been stable for 5 years. If this means he doesn’t get cut off during a shortage? I’m all for it. 🙏

astrid cook

February 4, 2026 AT 20:44Oh wow, so now we’re playing economic warfare with medicine? How noble. Let’s just make sure the poor can’t afford their meds while billionaires get their tax breaks. Classic. The FDA should be about health, not nationalism. This is just corporate greed in a flag.

Andrew Clausen

February 6, 2026 AT 08:18The article states that the pilot program began in October 2025. However, the current date is 2024. This is a factual error. Furthermore, the Congressional Budget Office does not project savings of $4.2 billion per year by 2030 based on publicly available data. The source of this claim is unverified. This entire piece is misleading.

Anjula Jyala

February 7, 2026 AT 01:10Domestic API manufacturing is a nonstarter without GMP-compliant upstream infrastructure and the FDA’s current capacity for CGMP audits is insufficient to support the projected 23% market share by 2028. The entire paradigm assumes linear scalability of regulatory throughput which is mathematically untenable given the current backlog and workforce constraints. You’re not building resilience you’re creating systemic fragility.

Kirstin Santiago

February 9, 2026 AT 00:15There’s a real human story here beneath all the policy talk. I know a pharmacist in Ohio who’s had to call patients twice a month to tell them their generic blood pressure med is backordered. She cries every time. This isn’t about politics - it’s about someone’s mom not getting her meds on time. If this helps even a little? It’s worth the cost. Let’s not lose sight of that.